Take Payments Internationally

With A Payment Gateway And Merchant Account That Serves

Low To Medium Risk , Or High Risk Merchants

A high-risk merchant account is a specialized payment processing service tailored for merchants categorized as high risk. Industries deemed high risk necessitate customized solutions to facilitate online credit card transactions for businesses within them.

We offer payment solution for all kinds of merchants located internationally in:

Australia, New Zealand, United States, Canada, United Kingdom, Europe and more.

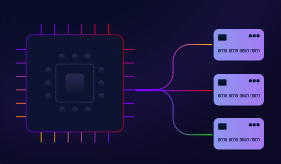

Multiple Payment Options

Bank cards

get paid online through debit or credit cards

E-wallets & QRs

effortless way to receive online payments

Bank accounts

direct payments through bank

transfer

Web payments

payment processing via web or mobile app

HIGH RISK MERCHANT ACCOUNT

A high-risk merchant account serves as a specialized payment processing solution tailored for businesses operating in unique sectors. Opting for instant approval services from certain providers can potentially result in account termination, leading to revenue loss. Gain deeper insights into high-risk industries by exploring payment review platforms offering valuable insights.

Securing a high-risk merchant account entails selecting a payment processing company specializing in your field. PayKings comprehends the distinctive requirements of your business and commits to guiding you through every stage of the process.

In addition to underwriting and approval, your payment processor should actively support the seamless operation of your high-risk enterprise. Our partners are equipped to assist you in fraud prevention, chargeback protection, and gateway integration, ensuring uninterrupted business functionality.

Your Aims Our Solutions

PayOut

To cards and e-wallets, web-based with no integration

Mass payouts

Using single API and manually

Flexible solutions

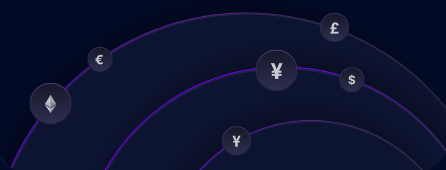

Standard fiat or alternative currency settlements

Customized pay form

Use our solution or your own webform

Single integration

Easy to integrate REST API with online support

Quick funds availability

Minimal time lag from client’s payment

Benefits of ContraPay

Fast and Secure Transactions

Competitive Exchange Rates

Wide Range of Payment Methods

Wide Reach

Compliance with Local Regulations

Online Customer Support

Get Started How to

Talk to sales

Engage with our sales team to delve into the distinct features of your business and receive customized offers tailored to your needs, complete with the most favorable terms available.

Explore APIs

Delve into APIs to grasp their functionality and integration possibilities, or seek guidance from your sales manager for assistance.

Pass KYC

Complete the KYC process for verification by furnishing a restricted set of details about your business to ensure regulatory compliance.

Get started

Execute a contract and incorporate new avenues for global payments, streamlining the purchasing process for your clientele.

Within two weeks of your initial contact, we can assist you in seamlessly integrating and launching our services, empowering your international business to broaden its horizons.

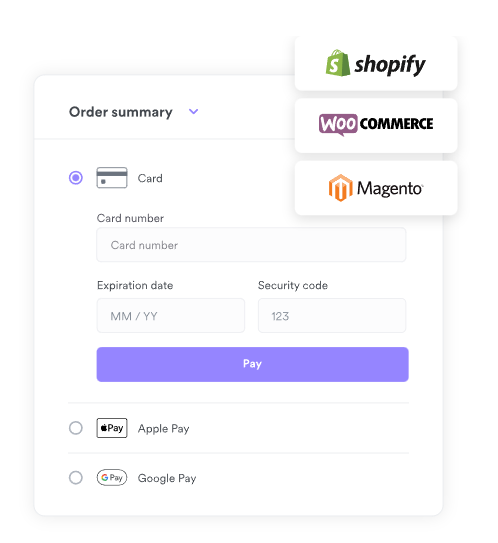

Plugins We Support

Created not only for developers. Easy to implement with end-to-end documentation and technical support to make integration smooth and seamless. We support the following platforms:

Woocommerce

Shopify

WordPress

Magento

Big Commerce

& more…

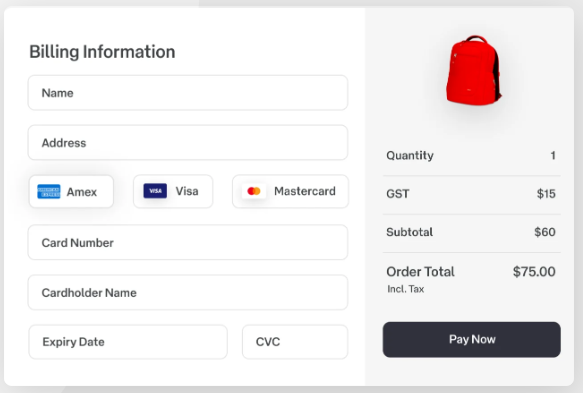

What is a payment gateway?

A payment gateway serves as the virtual bridge connecting online merchants and their customers, ensuring the smooth and secure processing of payments. This essential technology not only validates transactions but also encrypts sensitive payment data, safeguarding it from unauthorized access or potential breaches.

With its seamless integration into e-commerce platforms, a payment gateway enables merchants to accept various payment methods, including credit cards, debit cards, and digital wallets, providing customers with flexibility and convenience in completing their purchases.

Furthermore, beyond its role in authorization, a payment gateway plays a crucial role in facilitating the settlement process. It securely transmits transaction details to the merchant’s acquiring bank, initiating the transfer of funds from the customer’s account to the merchant’s account.

In essence, a payment gateway acts as the cornerstone of online transactions, ensuring both merchants and customers can engage in secure, efficient, and reliable payment processing, thereby fostering trust and confidence in the digital marketplace.

Contact us:

Frequently Asked Questions

A payment gateway serves as the intermediary technology facilitating seamless payment transactions by securely transmitting payment information among various entities, such as your web or app payment portal, banks, and card companies. Moreover, it assumes a crucial role in transaction security, employing multiple security measures like encryption, tokenization, and advanced tools to safeguard your payment details and ensure secure transactions.

A payment gateway stands as a cornerstone requirement for any online enterprise. It empowers you to seamlessly process online payments through a diverse array of over 100 payment methods, encompassing credit card transactions, bank transfers, cryptocurrency, and international currency exchanges directly into your merchant account. Consequently, it serves as a catalyst for amplifying your revenue streams and fostering lasting customer relationships.

A merchant account functions much like a standard bank account, enabling you to receive, store, and withdraw payments from your customers for the goods and services you offer. Essentially, it serves as the intermediary through which payments are received directly from your customers before being transferred to your primary bank account.

A high-risk merchant account is extended to merchants operating in industries deemed high-risk by banks and financial institutions. This specialized account comes equipped with enhanced security measures and chargeback prevention tools, offering added protection against fraudulent activities.

Numerous factors contribute to categorizing a business or merchant as high-risk. These may include the industry type, its reputation, geographical location, elevated chargeback rates, increased return volumes, susceptibility to fraud, dealing with high-value transactions, and poor credit history. Given these considerations, obtaining a high-risk merchant account becomes imperative for businesses operating in such circumstances.

Absolutely, you’ve got it! We’re thrilled to announce that we provide instant approval for payment gateways and merchant accounts. Just a few straightforward formalities to complete, and you’ll be all set to start accepting online payments right from day one.

Absolutely, you’ve got it! We’re thrilled to announce that we provide instant approval for payment gateways and merchant accounts. Just a few straightforward formalities to complete, and you’ll be all set to start accepting online payments right from day one.

As the foremost payment service provider globally, we boast an extensive array of offerings. Our diverse portfolio includes essential solutions such as payment gateways, merchant accounts, credit card processing, crypto settlement, e-invoicing, and a host of other payment options. Moreover, our comprehensive range of services caters to virtually every sector, spanning industries like forex, casino, gambling, gaming, escort services, adult novelties, streaming platforms, and beyond.

You can connect with us on WhatsApp, Skype, Linkedin, Facebook, and Twitter. You can also reach us at [email protected]. Additionally, you can fill us an inquiry form available at our website contrapay.net, and we will get in touch with you to assist you.